Mettalex: A Practical Implementation of AI Agents in the Web3 Ecosystem - Powered by Fetch.ai Agent Tech

Introduction

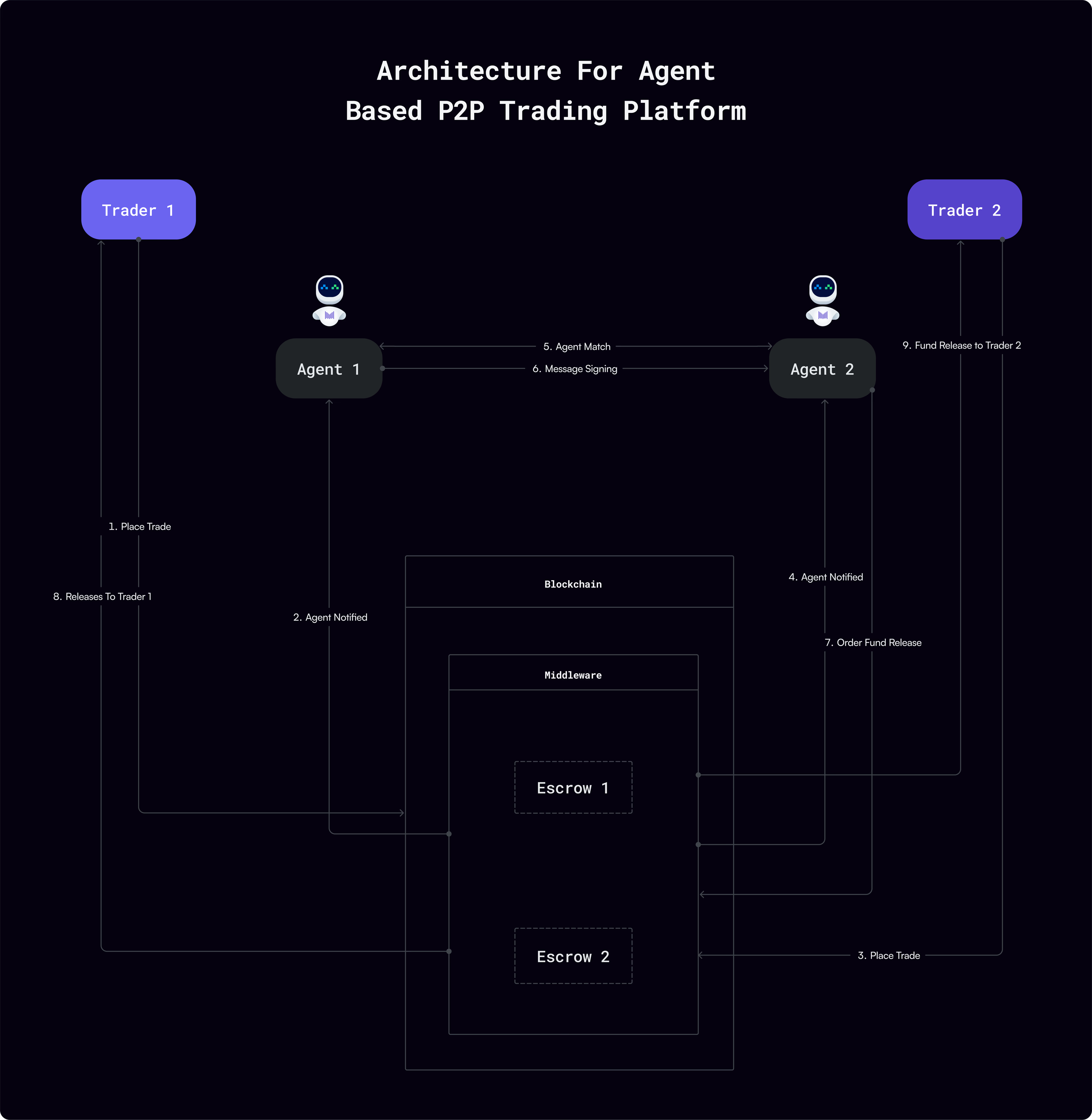

Mettalex stands out as the first P2P orderbook and agent-based DEX for commodity and digital (tokenized) assets trading. It harnesses Fetch.ai’s uAgents to power autonomous order matching, secure on-chain escrow, and cross-chain operations. By eliminating reliance on centralized order books or liquidity pools, Mettalex aims to offer slippage-free, trustless trades with maximum transparency.

Key uAgents features in this use case include their wallet- and chain-agnostic capabilities. Additionally, the agents provide a robust communication and execution layer, making the trading process seamless and efficient.

Mettalex: Agent-Based Commodity Trading in a Nutshell

-

Direct P2P Order Matching

- No Liquidity Pools: Mettalex uses uAgents to match buyers and sellers directly, eliminating AMMs and reducing slippage.

- Zero Slippage Execution: Final prices match exactly what each party has agreed to—crucial for volatile or low-liquidity commodity markets.

-

Escrow-Backed Settlement

- On-Chain Escrow: Traders lock funds in a smart contract. The agent only completes a trade if both sides have met the exact terms.

- Fail-Safe Mechanism: If either side fails to finalize the transaction, agents revert the escrow to protect user funds.

-

Multi-Wallet & Cross-Chain Support

- Wallet-Agnostic: Users may use MetaMask, Ledger, or any Web3-compatible wallet. The agent logic remains the same, ensuring a uniform trading experience.

- Chain-Agnostic: Mettalex agents can run on multiple blockchains in parallel (e.g., Ethereum, BNB Chain, Cosmos). They coordinate escrow locks and trades across networks if bridging solutions exist.

-

On-Chain Registration & Discovery

- Almanac Registry: Agents register on a Cosmos-based on-chain Almanac contract, allowing other agents/dApps to verify their identity.

-

Transparent Execution & Governance

- Public Transaction Logs: Every escrow creation, signature, and fund release is recorded on-chain. Users can view agent logs and track progress in real time.

- MTLX Governance: Mettalex’s governance token (MTLX) can let agents automate fee changes or protocol upgrades, broadening the platform’s agent-driven ecosystem.

Putting It All Together

- User places a trade -> Funds locked in escrow.

- Agent checks buyer/seller positions -> Confirms each side’s escrow.

- Agents sign trade parameters on-chain -> Escrows release funds upon successful match.

- Settlement -> Both parties receive respective assets with no slippage and full transparency.

If you wish to learn more about Mettalex, please visit Mettalex Docs.

Note: To try out Mettalex public beta system, where you can see the AI agent (built using Fetch agent tech) in action.